Incredible business strategy game played by ‘Rich people’

I called it a business strategy ‘game’ and not simply a business strategy because it’s a real smart and clever move that rich people play by panning their cash flow. I know it sounds misleading like a spam or a clickbait but as per Robert Kiyosaki, it’s not.

Now who is Robert Kiyosaki? He is an author of a personal finance book of all time, Rich Dad, Poor Dad. This book offers financial education and teaches us on how to get that financial independence and early retirement we all crave for. It helps us to increase our financial IQ which quite honestly, most of us lack in.

What is the idea behind this business strategy?

It’s quite simple as it can get. Did you know 70 percent of the world population lives on paycheck to paycheck? Did you know 95 percent of that 70 percent would do anything to quit that immensely tiring and torturing job?

When we work for let’s say our boss, or our boss’s boss, we are making them richer. For every extra hour that we spent on our jobs, doesn’t really make a huge difference to our incomes. Sure we might get a raise after our boss cajole us in doing something what made him earn a million dollars. We only get a teeny tiny amount of that buttload of cash.

But you see I’m not asking you to quit your jobs today and just sit at homes and then cry about your sad life. No. I’m just trying to tell you that even with your jobs, there is a way that can help you with an early retirement and financial freedom. That can help you to generate continuous cash flow or passive income as we may call it. And this game of business strategy is introduced by the rich successful entrepreneurs only but of course it’s done with a lot of planning beforehand.

These sources of passive income will not help you get rich quick overnight. This is not some sort of magic. Because well if you want magic, you’ve come to a wrong place. This is a well planned business strategy taught to us by Robert Kiyosaki himself.

Related: What is 1 Simple Strategy that will change your life?

What actually is this business strategy?

You know how we all are taught to complete our education and get a job and get married and then wait for our eternal demise. Yeah that one. Well according to Robert, that’s no way of living. And I think it’s true. We only live once you know, I mean I believe it. Why are we all in this rat race I don’t understand.

Now before further going into senseless talking let’s get to business, shall we? Get ready to listen to the game that all those millionaires and billionaires are playing by applying this business strategy. This will explain how they are making money with no money.

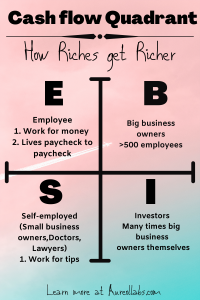

The Cash flow Quadrant

Our school education systems don’t really tell us the difference between the first and the second column i.e. between E &S and B & I.

Most of us want a high paying job i.e. become an employee so that we can pay our student loan debts, rent a good house, pay mortgages etc. And I am also equally guilty of this. Now people who live like this and are ‘working for money’ comes under E&S category, mostly. And this is the mistake that rich people don’t make. They know the difference between assets and liability. And through their experience and knowledge, they strive for financial independence and early retirement.

What are Assests and Liabilities?

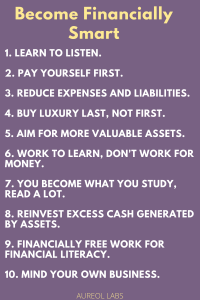

Each one of us is focused on working for money. It shouldn’t be that way though. We should be learning more than working for money. We are so much focused on earning and paying our bills that we forget that the things we think are our assets are actually our Liabilities. Instead of making our life simpler and helping us financially, they are draining our money away from us. This is the basics of the game of business strategy and yet less that 1% of the population use this.

Assets- put money into your pocket

Liabilities- take money out of your pocket

Let’s begin with an example. Suppose you buy a house because you got a raise. But you’re forgetting that the same house will cost you even more money with the taxes and the mortgages etc. The house which you considered as one of the sources of investments has become a liability now.

Obviously it doesn’t mean that you cannot live in a dreamy house but it means that you must know beforehand that the house you’re buying doesn’t become a liability.

The game of business strategy that riches play is controlling their cash flow. Everything is just about the cash flow. The better financial education you have, the better cash flow you’ll be able to maintain.

What is cash flow?

Cash flow is the net amount of cash being transferred in and out of a business or in general, of any individual. Our aim is to generate a positive cash flow. So that we are able to save some money for ourselves. Maintaining a positive cash flow means we should be spending less than what we are making. Sounds simple no? Doesn’t happen quite often.

And they don’t teach us this in schools. They don’t teach us how to gain financial independence and how to aim for early retirement. You’ll have to learn this your own way or by books like what we are talking about. Now let’s see how can we convert our Liabilities into assets and turn our cash flow positive.

How to use a Liability as an Asset?

I’ll start with a story. Suppose Lucy has no money. But she does own a property which she bought many years ago. Now that property isn’t really making any money. It’s just sitting there vacant and useless.

Now Lucy decides to renovate the place a little and make it available for the tenants to live in. This way the property which was useless and wasn’t doing any good to her is now generating income or more like it has become a great source of passive income. And as long as there are tenants in that building, she doesn’t have to actually work for money. Those assets are making money for her.

And according to Kiyosaki, real estate investment is one of the best sources of passive income because it opens different other sources of income itself.

Let’s go back to the previous example of Lucy. Now the tenants are happy, Lucy is happy that she’s earning money without even working for it. She thinks of an idea of putting washing machines in the basement of the building. Washing machines are more likely one time investments.

But now she can charge tenants for using the dryers and obviously tenants are happy because they don’t have to go to a different place just for laundry. So this way washing machines have also become her assets.

Conclusion

In the end, even if you’re working for someone, get yourself some financial education. Don’t just keep saving the money in banks or buying things which would eventually become liabilities. Keep investing in assets.

I’m not saying jump directly into real estate investment but you can at least start with some amount of your income right, even if its 1%. But remember the key to invest money is to generate passive income and maintain that cash flow. So that all your income doesn’t get spent in covering the expenses just like we talked about in profit first strategy.

You want that one day those assets or those sources of passive income start generating so much money that it becomes your main source of income . And your life no longer depends on that one particular job. I hope after reading this, we’ll stop throwing money away and rather invest that money in something which will helps us move one step closer to early retirement and financial independence.

P.S. Do check our new tool on our website for intelligent and cool quotes & captions for your social media as well as blogs – CAPTAGRAM

Wow! There can be no other sure route to early retirement than retiring on positive cashflow from a investment.

Yes, on point.